supply of domestic oil at the price of 2 years ago; How did the foreign shareholder come and why did he leave?

According to the reporter of Mehr, news about the withdrawal of capital transition Saudi Arabia raised concerns about Iran's food industry market at the beginning in supplying the vegetable oil and liquid market; But according to emphasis Managers of this market, there is no concern in this regard and production continues without interruption.

In supplying the edible oil market (liquid and semi-solid), Iran depends more than 90% on the import of oilseeds such as soybeans, sunflowers, etc.; Of course, crude oil also accounts for a part of this import.

Oil is obtained from oil seeds, about 3 million tons annually The seed comes in It becomes a country. About 540,000 tons of extracted oil and crude oil are obtained from this figure. Crude oil is refined and packaged in factories and enters the market as edible oil.

It should be noted that the country's annual need for oil is between 1.5 and 1.6 million tons.

The profit margin led to the exit of foreign investors

Some brands with foreign investment have been present in the oil market for several years. But the strategic change of this capital company transition Saudi Arabia in basket Its business led to its withdrawal from the food industry market.

company Safolaone of the largest industrial companies in Saudi Arabia, was established in 1979 with a capital equal to 40 million Saudi Riyals. This company operates in various fields including food industry, retail and various investments.

This company started with the aim of producing edible oils and vegetable fats. Over time, the company expanded its scope of activities and became one of the largest food producers in the region.

The production of products such as edible oils, sugar, pasta, frozen food, marine products, industrial breads, nuts, spices, beans, dates, dried fruits and sweets was part of the scope of this international company's activities in different countries.

In recent years, Safola It has made important changes in its capital structure, so that in 2024, this company will increase its capital by 112.4% through the supply Priority rights worth 6 billion rials, which is the second largest capital increase in date It was the Saudi stock market.

Also, the company repurchased and canceled its sukuk of various denominations to improve its capital structure and reduce financing costs.

Some reasons for leaving Safola This is related to strategic change Holding Knowing that in order to participate in the American stock exchange, he has to leave not only Iran But others countries has been

According to some capital market experts, of course, the inflation rate in Iran and the decrease in the value of this company's shares cannot be ignored; In addition to the fact that in the global market, the profit margin of the food industry is low compared to the mineral industry.

Holding Savolai Saudi Arabia, whose share of the edible oil market in Iran is estimated at 19.8%, for the first time in 2003 as part of His strategy and development plan entered the Iranian market at that time. In this regard, he bought 49% of Behshahr Industrial Group in the field of edible oils at a cost of 290 million Rials. Company name to Safola Behshahr changed.

In that year, the oil market witnessed a price war when the main industrial companies in Iran were consolidated with the aim of reducing production costs and increasing profitability. Safola After adopting a series of measures to reduce production and administrative costs, Behshahr was able to increase its profitability.

The price war in 2009 became a problem again and led to a decrease in the profit margins of industrial companies, but this company was able to register a net profit of 200 million rials by the end of the same year.

The share of this group in Safola Behshahr, which has three edible oil factories in Iran, in 2008 through its subsidiaries, Behshahr Industrial Company, Manufacturing Company Margarine And Behshahr Arvand company reached 80%. According to the then board of directors report, the company sold 79.9% of its shares in the margarine production company in 2024 with the aim of improving efficiency and reducing operational problems.

The shares are registered in the name of the Emirati company

The Iranian Rial lost 90% of its value due to the sanctions order It exacerbated the inflation rate Based on According to the data of the World Bank, by the end of 2023, the figure reached 45%, making Iran the eighth best country in the world opinion Inflation turned. This issue increases the exchange rate risk for capital companies transition became foreign

Finally that Safola one Holding International food production Saudi Arabia with Subsets In the countries of the Middle East and North Africa, its shares were held by a capital transition Iran was purchased.

Based on Information Kodalthe company Safola food International was registered in the United Arab Emirates, more complete information can be seen below.

It should be said, this capital transition Iranian and active in the oil market, which supplies 20% of the market and has 12 subsidiary companies, the company Safola Has bought Behshahr (owner of Laden brand) worth 200 million dollars.

Of course, the information on the transfer of shares is undergoing legal procedures and has not yet been registered in the official gazette.

Mehr reporter contacted the CEO of Behshahr Industrial Group (public shares) to follow up on how to hand over shares and more details, but no response was received.

What does Safola's statement say?

as well who came Safola Saudi Arabia has left not only the Iranian market but also other countries and started selling its shares.

Based on The statement that the group Safola Published on Wednesday, December 12, suspension of activity Safola In Iran, “it has been done in line with the group's strategy to exit non-core markets in time” and this group had previously withdrawn from its investments in Morocco and Iraq and transferred its shares in 2023.

While some, this action Holding Saudi Arabia to the coming of Trump and increased pressure Communication area given, but the fact is that due to financial losses and the need for liquidity, Safola Start selling all assets abroad He has done and is supposed to basket Change your business.

The oil market is supply

In response to the concerns in the country's oil market, Akbar Fathi, Deputy Minister of Agricultural Jihad and Secretary of the Food Security Coordination Staff, stated that no infrastructure has been removed from the country and all internal capacities are still intact. emphasized that there is no problem in the supply of domestic oil and all market, supply and production issues can be monitored and complete planning has been done in this regard.

Vice President of Planning and Economic Affairs in particular An increase in the price of oil at the same time as the issue of selling stocks Safola and worry created In the domestic market clarification Given that the recent price increase related oil It is due to the increase in the global price of this product and has nothing to do with the transfer of shares of this company.

According to the emphasis of the Deputy Minister of Agricultural Jihad, considering the very good investments that have been made in the country's oil and oil extraction, as well as the imports from before to the extent enough done, we have no problem in the market; while registering Orders It continues without obstacles and restrictions.

Referring to the strategic reserves, Fathi said that the internal reserves are up to it is enough.

This government official in particular The possibility of profiteering was mentioned by some, after the increase in the price of oil due to the increase in the global price, some producers or importers did not market their products. And some unions said about the shortage and rising prices, while there was no problem in terms of supply, and this issue was after the official announcement of the rate by the regulatory headquarters. The market is fixed.

Selling shares due to changing business portfolio

Taimur Mohammadi, a member of the Board of Directors of the Iranian Vegetable Oil Industry Association, told Mehr reporter that there is no definitive information about the exit of this Saudi Arabian company from the commodity exchange. But the work to register the transfer of shares is being pursued.

This member of the Board of Directors of the Association of Vegetable Oil Industries about the oil market in the conditions current He stated that it is expected that the situation will improve and we will not have any problem in supplying the market and prices; Because the ability of domestic production companies in the field of oil extraction and edible oil production is high.

Mohammadi about the reason for the withdrawal of this capital transition The foreigner said, the words indicate the change of the business portfolio of this company Why? that the food industry does not have the profit margin of industries such as cement and steel; Therefore, this company is looking to invest in new industries with higher profit margins. This capital transition Saudi Arabia is going to invest with a new approach in industries that have a higher profit margin.

Statement of the Iranian Oil Industries Association

Iranian Vegetable Oil Industry Association announced in an announcement that the company Safola Behshahr owns about 80% of the shares of Behshahr Industrial Company and there is no change in the shareholders major And it has not been done directly by the said company.

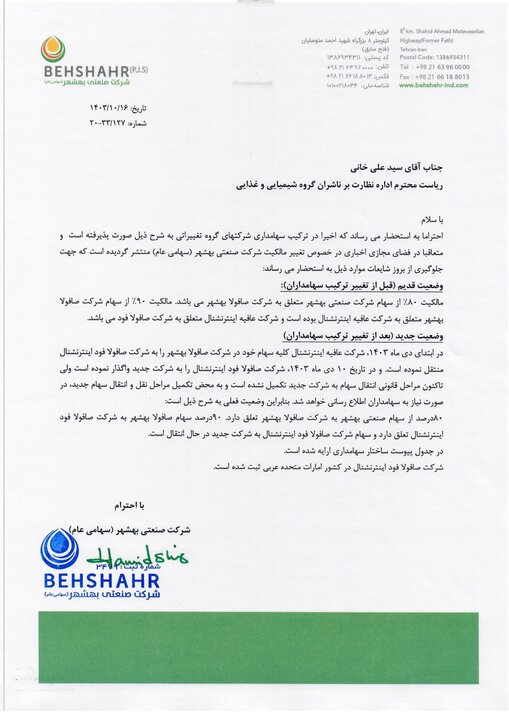

Based on This announcement, the market share of Behshahr Industrial Company is about 19% and the shareholders major The mentioned company is the former shareholders and production and Distribution This company is like before continues, and what happened was the transfer of shares of one of the company's shareholders, the details of which are given in letter No. 20-33/127 dated 16/10/1403 Behshahr Industrial Company has been notified to the Tehran Stock Exchange and Securities Organization.

It is also stated in this announcement: current yearCompared to last year, the production of vegetable oil has increased significantly and it is expected that production current year exceed 2.2 million tons.

It is specified in this notice, the prices current Vegetable oil even from the prices of two years before It is also cheaper and the current prices will not increase at least until the end of the year.

Source:mehrnews